The surprise release of GTA 6's second trailer has reignited the hype around one of the most anticipated games in years. I first played GTA: Vice City when I was just 10 (yes, I know — it was rated 18+). I used to come home from school, eat lunch, fire up the PlayStation, and spend my afternoons cruising around Vice City with Flash FM playing in the background.

Today, playing a new GTA isn’t just about gaming — it’s a nostalgic dive back into adolescence.

When people say “the ‘80s had the best music,” I don’t always agree. But I get it. Music from Fever 105 or Flash FM brings back memories of simpler times: family, peace of mind, no financial worries. That’s why the upcoming release of GTA 6, set for May 26, 2026, means more to me than just a new game.

I don’t even own a console today. And to be honest, I don’t have the money to buy one either. If you’ve been following my monthly financial updates here on the blog, you’ll know that every franc I earn is carefully divided between savings, debts, and small investments.

Buying a PlayStation 5 or Xbox Series X — plus the game — would cost me at least CHF 600. That’s a lot when you’re watching every expense.

There are 12 monthly paychecks left until the game is released. My goal? To save the money by investing in… GTA 6.

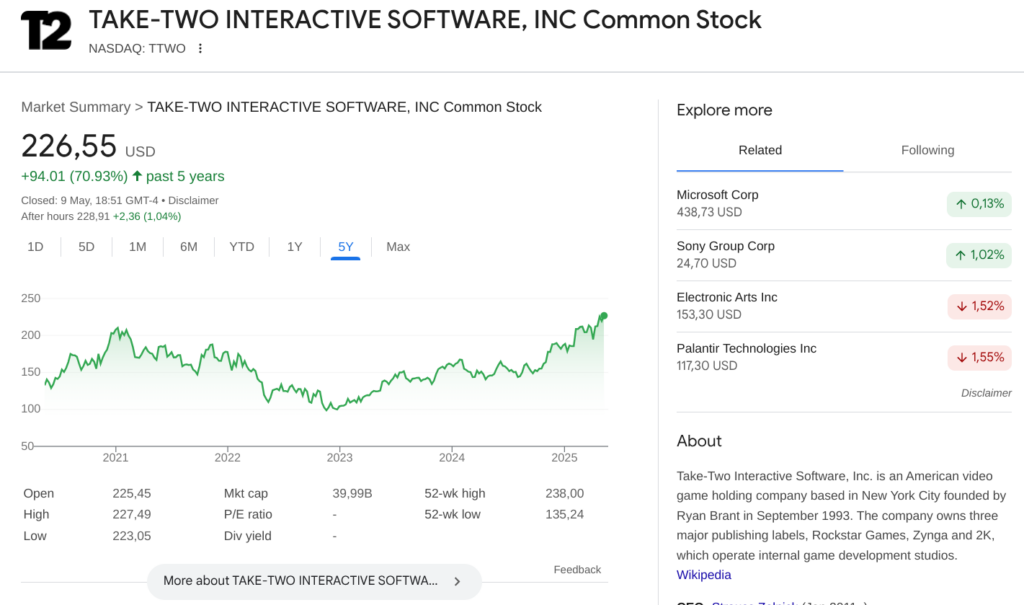

Each month, I’ll invest CHF 50 into fractional shares of Take-Two Interactive (TTWO) — the parent company of Rockstar Games, which develops GTA.

The idea is simple: if Take-Two’s stock rises around the launch — or if they announce an online version that brings in recurring revenue — I could sell my shares and use the gains to buy the console and the game. Of course, it’s a personal bet, not a guaranteed strategy. Take-Two has already forecasted strong results, so some of that hype might already be priced in. But I believe the launch will attract enough attention to move the stock.

⚠️ Disclaimer

I’m not a financial advisor. This is not investment advice — just a personal project based on my passion for GTA and the idea of mixing nostalgia, saving, and learning about investing.

I’ll be using Revolut to buy the shares. The platform lets small investors buy fractional shares — perfect if you’re working with a tight budget.

I already use Revolut to convert part of my salary into euros and send it to other accounts. For this project, I’ll simply convert a few extra francs each month and invest them. There are some fees, but they’re low and manageable for a small-scale experiment like this.