As I do every month, here’s the latest update on my financial journey – this time for April 2025.

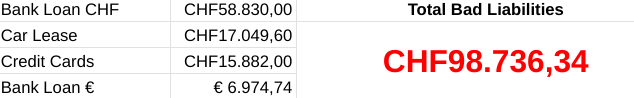

No major shake-ups this month, but a small win worth mentioning. I contacted the customer service of my Swiss bank (the one that issued my loan in CHF) to ask how much I had left to repay. Since that info isn’t available in their app, they kindly sent me a PDF with all past transactions and interest payments.

Thanks to that, I was able to update my Excel sheet and spot a small mistake: I had overestimated the remaining loan amount. A nice surprise, even if the total is still significant.

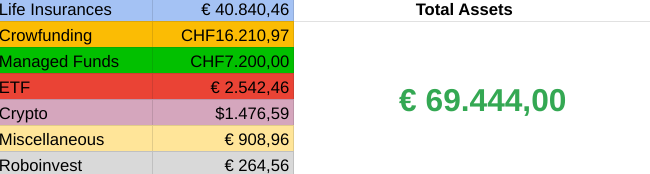

On the asset side, things haven’t changed much, but my net worth has still increased by around €1,600 compared to March (read last month’s update).

I didn’t invest in any new ETFs or cryptocurrencies – not out of caution, but simply because I don’t currently have funds available to invest further.

🔍 Note: The figures shown represent the money I personally invested, not the current market value of each asset.

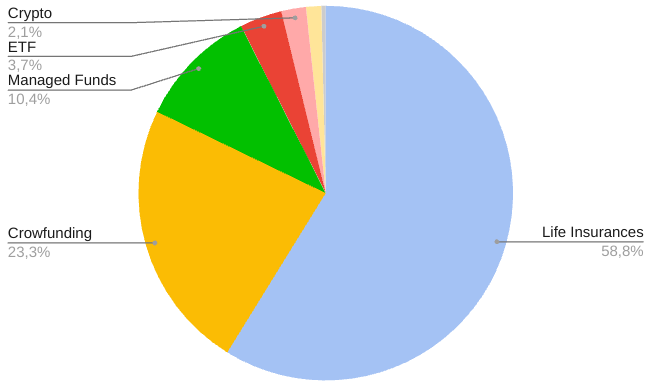

As in previous months, there haven’t been major changes here either. Percentages are nearly identical to March. My medium- and long-term goal remains to gradually reduce my reliance on older insurance-based investment products.

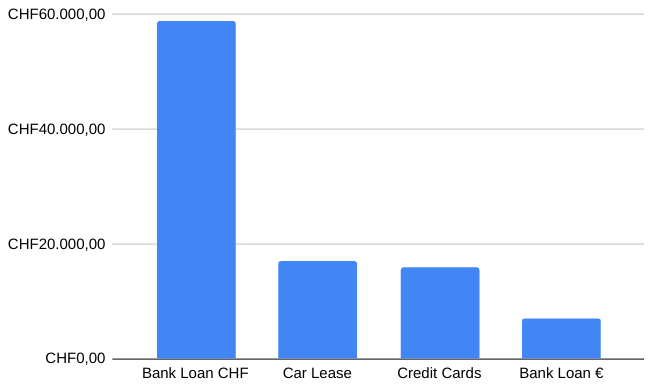

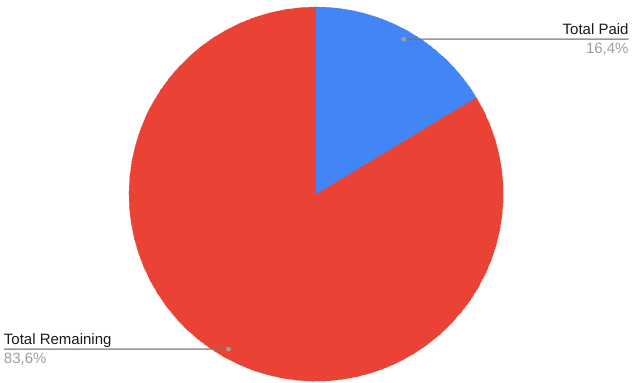

Even with the Excel fix, my bad debt section still weighs heavily. My main loan in CHF continues to be the biggest burden, although I pay a bit more than the minimum each month to slowly reduce interest costs.

My credit cards are another major issue – the interest rates are painfully high. Unfortunately, I still need to use them for everyday expenses. I had no other option at times.

The only debt I repay with some peace of mind is the monthly mortgage for a property I bought abroad. It's currently rented out, and the rent more or less covers the monthly payment. It's a long-term bet, but one I feel confident about.

April was a relatively quiet month. I fixed some Excel errors, gained better insight into my numbers, and am preparing for a trip to an exotic destination at the end of May. Sadly, I couldn’t save as much as I had hoped, so one of my credit cards will probably come into play again.

This blog is my way of documenting a real-life financial recovery – with its mistakes, progress, and occasional setbacks. If even one person finds value or inspiration in my story, it will have been worth it.

🌱 It doesn’t matter where you are today. What matters is where you’re heading tomorrow.

See you next month!