As every month, I’m sharing a new net worth update for May 2025. I’ve just returned to Switzerland after spending ten days on the other side of the world, and I’m ready to review where I stand financially.

Despite past mistakes (which I’ve written about here), I’ve decided not to give up on enjoying life. I make sure all my fixed expenses are paid first, and if there’s room in the budget, I travel. Life is short — and I want to live it.

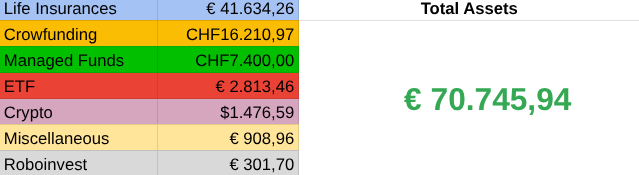

This month, there’s not much to report. I’ve continued investing as usual: ETFs, life insurance, and my automatic investment plan with Neon Invest.

No new moves in crypto or crowdfunding — and I don’t plan to add any in the coming months either. Right now, I’m focusing on building up my ETF positions and adding a few individual dividend-paying stocks to create monthly passive income.

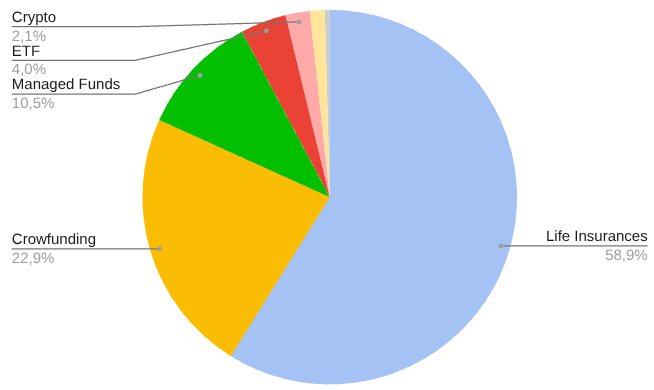

My portfolio hasn’t changed much since last month (see April’s update here). Life insurance still makes up the bulk of my assets — long-term investments that remain a key part of my strategy.

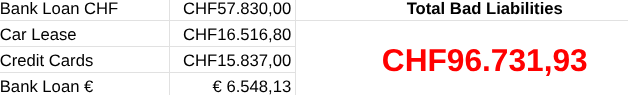

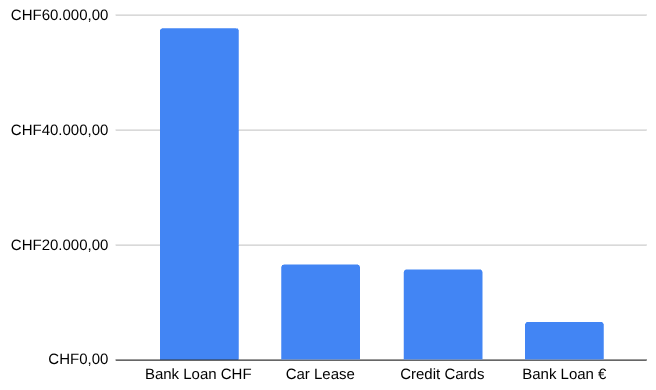

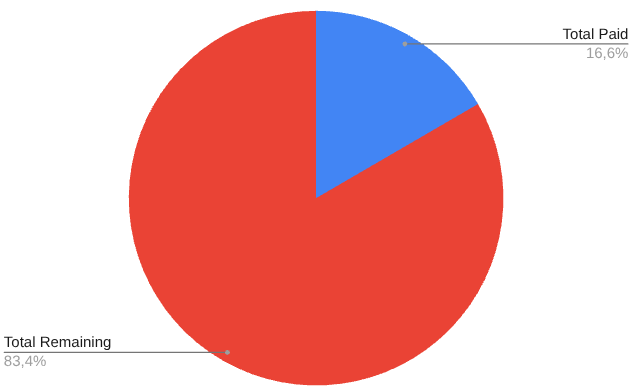

My “bad debt” — meaning loans that don’t generate any return — remains stable. I’m making monthly payments as planned. Unfortunately, these are long-term burdens.

The only “good debt” in my portfolio is a mortgage on a property abroad. The rent helps cover the loan, making it a manageable, long-term investment. No major changes to report here either.

May turned out to be a calm month, and that’s already a win. I managed to enjoy my holiday without any financial slips — no credit cards, no surprise expenses, no currency exchange fees.

Over the next few months, I want to continue increasing my ETF exposure and gradually build a small portfolio of dividend-paying stocks for a modest passive income.

No step backward is already a step forward. And if I can save, invest, and still enjoy life, I must be on the right track.